Market Overview:

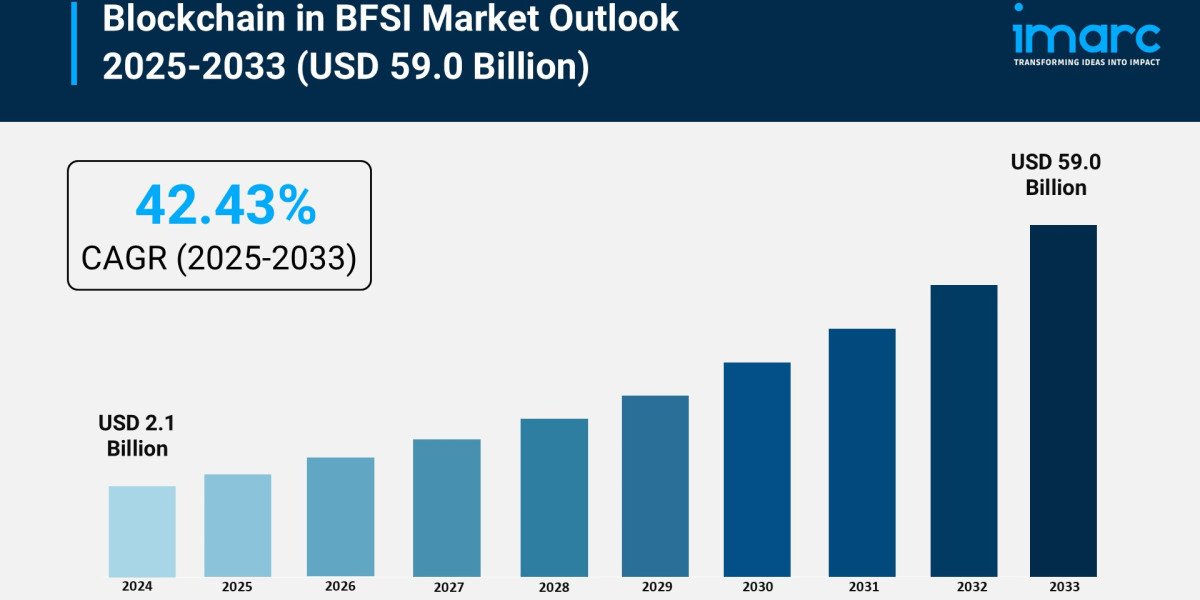

According to IMARC Group's latest research publication, "Blockchain in BFSI Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global blockchain in BFSI market size reached USD 2.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 59.0 Billion by 2033, exhibiting a growth rate (CAGR) of 42.43% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Blockchain in BFSI Market

Predictive analytics powered by AI help banks analyze blockchain transaction patterns, reducing compliance costs by 30% through automated regulatory reporting and audit trails.

Financial institutions deploying AI-blockchain solutions report 25% improvement in customer onboarding time, with decentralized identity verification replacing traditional KYC processes.

Over 35% of banking consumers demand visible security measures for high-risk transactions, driving AI-enhanced blockchain adoption for transparent and secure payment processing systems.

AI algorithms optimize smart contracts on blockchain platforms, automating loan processing and claims management, with banks saving up to USD 12 billion annually by 2025.

The BFSI sector leads blockchain AI integration, with the global blockchain AI market projected to reach USD 4,338.66 million by 2034, growing at 22.93% CAGR from enhanced operational efficiency.

Download a sample PDF of this report: https://www.imarcgroup.com/blockchain-in-bfsi-market/requestsample

Key Trends in the Blockchain in BFSI Market

Rapid Adoption of Smart Contracts in Banking: Smart contracts dominate the application segment, automating loan processing, claims management, and compliance tasks without intermediaries. Banks estimate savings of USD 12 billion per year by 2025 through smart contract implementation, reducing settlement times from days to minutes and eliminating manual verification processes.

Central Bank Digital Currencies (CBDCs) Expansion: Central banks across 114 countries are exploring or developing CBDCs, creating substantial demand for blockchain-based payment systems. China's digital yuan has processed over USD 13.9 billion in transactions, while the European Central Bank's digital euro project is scheduled for potential launch by 2028.

Cross-Border Payment Revolution: Blockchain-based cross-border payments are gaining momentum, with transaction values expected to reach USD 5 trillion by 2030. Traditional international remittances taking 3-5 business days are being revolutionized through blockchain solutions enabling near-instantaneous settlements at significantly reduced costs.

Integration with Emerging Technologies: The convergence of blockchain with AI, IoT, and cloud computing is driving innovation. In July 2024, Grayscale launched the Decentralized AI Fund to capture growth at the intersection of blockchain and artificial intelligence, demonstrating growing institutional interest in integrated solutions.

Tokenization of Traditional Assets: Financial institutions are increasingly tokenizing securities, real estate, and commodities on blockchain platforms. This allows for easier trading, fractional ownership, and increased liquidity in traditional financial markets, with blockchain-based trade finance reducing the global pay gap by USD 1.5 trillion.

Growth Factors in the Blockchain in BFSI Market

Enhanced Security and Fraud Prevention: Blockchain's decentralized and immutable ledger system effectively minimizes risks of fraud, data breaches, and cyber-attacks. Financial institutions are adopting blockchain to address growing cybersecurity threats, with cybercrime around cryptocurrency expected to reach USD 30 billion yearly by 2025.

Regulatory Compliance and Operational Efficiency: The heavily regulated BFSI sector is leveraging blockchain for efficient regulatory compliance and streamlined operations. Blockchain technology enables 30% lower bank infrastructure costs, with implementation potentially reducing operational expenses significantly across the industry.

Rising Demand for Transparent Transactions: More than 35% of banking consumers want financial institutions to implement advanced visible security measures for high-risk transactions. Blockchain provides unparalleled transparency through its distributed ledger, building consumer trust and institutional confidence.

Digital Currency Adoption Surge: The growing acceptance of cryptocurrencies like Bitcoin and Ethereum has increased interest in blockchain technology. The global cryptocurrency market reached USD 2,255.2 billion in 2023 and is expected to reach USD 5,552.8 billion by 2032, driving blockchain infrastructure demand.

Strategic Partnerships and Investments: Increasing partnerships between BFSI institutions and technology companies are accelerating blockchain adoption. These collaborations focus on developing blockchain solutions to address industry-specific challenges, with major players like JPMorgan processing over USD 1 billion in daily blockchain transactions.

Leading Companies Operating in the Global Blockchain in BFSI Industry:

Accenture plc

AlphaPoint

Amazon Web Services Inc.

Auxesis Services & Technologies (P) Ltd.

Infosys Limited

International Business Machines Corporation

Oracle Corporation

Blockchain in BFSI Market Report Segmentation:

Breakup By Type:

Private

Public

Consortium

Hybrid

Public accounts for the majority of the market share, characterized by open and decentralized nature allowing unrestricted participation with high security levels.

Breakup By Component:

Platform

Services

Platform holds the largest share, providing essential infrastructure for deploying blockchain solutions with features like immutability, transparency, and decentralized ledger systems.

Breakup By Application:

Digital Currency

Record Keeping

Payments and Settlement

Smart Contracts

Compliance Management

Others

Smart contracts represent the leading segment, automating complex contractual processes, reducing intermediaries, and ensuring compliance with transparency across financial operations.

Breakup By End User:

Banking

Insurance

Non-Banking Financial Companies (NBFCs)

Banking exhibits clear dominance, increasingly adopting blockchain for transaction processing, compliance management, fraud prevention, and customer identity verification.

Breakup By Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America leads the market owing to advanced technological infrastructure, early blockchain adoption, presence of major financial players, and supportive regulatory frameworks driving innovation.

Recent News and Developments in Blockchain in BFSI Market

July 2024: Grayscale launched a new digital asset fund focusing on artificial intelligence (AI) tokens. The Grayscale Decentralized AI Fund was designed to capture the growth of protocols at the intersection of blockchain and artificial intelligence.

June 2024: Mastercard launched crypto credentials to simplify digital transactions. Mastercard's Crypto Credential integrates blockchain technology into traditional financial services, designed to simplify and safeguard cryptocurrency transactions.

June 2024: Metallicus, the core developer of Metal Blockchain, announced OneAZ Credit Union's enrollment in its Banking Innovation Program, signifying OneAZ Credit Union's proactive approach to exploring blockchain technology's potential.

March 2024: Infosys Limited launched a blockchain-based trade finance platform enhancing transparency and reducing fraud in international trade, significantly improving efficiency and trust in cross-border transactions.

January 2024: Qila launched its Blockchain-As-A-Service (BaaS) platform. The platform, which includes innovative solutions such as PrivaSea and GoTrust, focuses on delivering secure identity data storage through blockchain technology.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302