Mobile micro-payment cash conversion, known as 소액결제현금화 in Korea, has become an innovative financial solution for individuals seeking immediate access to funds using their mobile payment limits. This service allows users to convert small-scale mobile payments, often originally intended for app purchases or subscription services, into cash that can be used for everyday expenses. It offers a fast, convenient, and flexible alternative to traditional banking or loan services.

How the Process Works

The process of converting mobile micro-payments into cash is simple yet secure. Users typically authorize a certain amount through their mobile carrier or payment app, which is then converted into a transferable cash equivalent. Depending on the service provider, the cash can be deposited directly into a bank account, a digital wallet, or even provided as a prepaid card balance. This quick conversion process often completes within minutes, making it ideal for emergency expenses or urgent financial needs.

Benefits for Users in Korea

One of the major benefits of mobile micro-payment cash conversion is accessibility. It allows individuals without extensive banking experience or credit history to access funds quickly. The service is especially useful for freelancers, students, and small business owners who need immediate liquidity. Additionally, since the process leverages existing mobile payment limits, it reduces the reliance on traditional loans, credit cards, or high-interest borrowing.

Security Measures and Trust Factors

Security is a critical aspect of mobile micro-payment cash conversion. Reputable service providers implement multi-layered verification, encryption, and transaction monitoring to protect users’ personal and financial information. This ensures that users can safely convert their mobile credits into cash without the risk of fraud. Transparent terms and clear fee structures also help users understand costs upfront, building trust and reliability in the system.

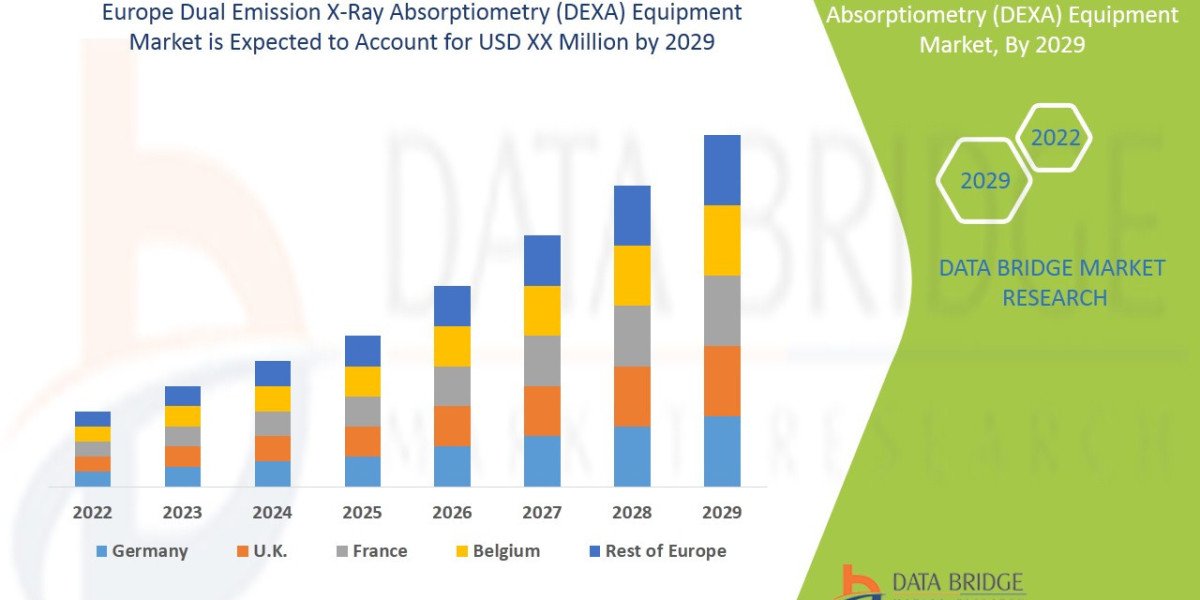

Trends and Growth in the Korean Market

The popularity of mobile micro-payment cash conversion in Korea has grown rapidly due to increased smartphone penetration and the rise of digital payments. More companies are offering user-friendly platforms, integrating mobile apps with cash conversion services, and introducing rewards or incentives for frequent users. This trend reflects a shift in consumer behavior, where flexibility, speed, and convenience are prioritized over traditional banking methods.

Potential Considerations and Responsible Usage

While mobile micro-payment 소액결제현금화 conversion offers numerous benefits, responsible usage is essential. Users should monitor their spending limits, understand service fees, and avoid over-reliance on this method for long-term financial management. By using it as a tool for short-term cash needs or emergencies, individuals can maximize the benefits while minimizing risks.

Conclusion: The Future of Mobile Cash Solutions

Mobile micro-payment cash conversion represents a new frontier in personal finance, combining convenience, speed, and accessibility. In Korea, it has become a vital financial tool for those seeking quick cash without the complications of traditional banking. As technology continues to advance and more services emerge, this system is poised to play an increasingly important role in daily financial management, offering users both flexibility and peace of mind.